The Latest in HVAC Efficiency and Refrigerant Regulatory Changes

The HVAC industry is preparing for the next round of refrigerant and efficiency regulations for air conditioning and heat pumps. Although the industry has a significant amount of experience in increasing efficiency and transitioning to new refrigerants, the timing and uncertainty have made this regulatory cycle more complex.

The Kigali Amendment to the Montreal Protocol

Although most associate the Montreal Protocol with phasing out ozone-depleting substances, it has also been evaluating the global warming potential of HFCs for over a decade. In 2016, 197 countries met in Kigali, Rwanda, and agreed on a global proposal to phase down HFCs. The Kigali Amendment required ratification from at least 20 countries to take effect. To date, 163 countries have ratified it. As such, it took effect for participating countries on January 1, 2019.

Federal HFC Legislation

The American Innovation & Manufacturing Act (AIM Act) was signed into law in 2020, granting the federal government the authority to regulate HFC refrigerants in three primary ways via the Environmental Protection Agency (EPA).

- Phasing down HFC supplies by reducing their production and consumption over a 15-year period. These supply-side restrictions began on Jan. 1, 2022, requiring a 10% reduction in HFC production and consumption through 2023. Per this HFC phasedown schedule, an additional 30% reduction will take effect between 2024 and 2028 — with 70% and 80% reductions needed by 2029 and 2034, respectively. Not only are these phasedowns expected to drive up the price of HFC refrigerants as supplies decrease, but they also signal the end of a high-GWP HFC era in HVAC.

- Establishing sector-based approvals and HFC restrictions that facilitate transitions to next-generation refrigerant technologies. HFC use restrictions would help specific sectors to transition more quickly away from higher-GWP HFCs while providing additional flexibility for those who may need more time. A key aspect of this effort includes the EPA’s authority to support the demand for lower-GWP refrigerants by approving new alternatives per sector-based application guidelines.

- Regulating HFC management by establishing standards for the management of HFCs in servicing and repair processes, such as: lowering leak rate thresholds and requiring proper recovery of “used” HFCs for purification and resale (aka reclaim). This would allow for an efficient transition from HFCs in accordance with reductions in production and consumption schedules.

California Air Resources Board (CARB)

In absence of regulatory certainty at the federal level, many states have adopted environmental regulations that seek to limit the negative impacts of short-lived climate pollutants (SLCP) such as HFCs. California was the first state to take official action. California Senate Bill 1383, also known as the Super Pollutant Reduction Act, was passed in 2016 and requires that Californians reduce F-gas emissions by 40 percent by 2030. Another related bill, California Senate Bill 1013 was signed into law in Sept. 2018. Referred to as the California Cooling Act, this law mandated the full adoption of SNAP Rules 20 and 21 as they read on January 3, 2017. The California Air Resources Board (CARB) published the adoption of SNAP Rules 20 and 21 as state regulations at the end of 2018.

To reach the 40 percent reductions required by 2030, CARB also proposed an aggressive second phase of rulemaking that will further impact AC applications. This HFC rulemaking was published at the end of 2021 and entered into effect January 1, 2022.

In air conditioning applications, CARB has a targeted a 750 GWP limit across multiple end-uses:

- 2023: room AC and dehumidifiers

- 2024: AC chillers (consistent with SNAP Rule 21)

- 2025: residential and commercial AC

- 2026: variable refrigerant flow (VRF) systems

CARB also introduced its Refrigerant Recycle, Recovery and Reuse (R4) program, which requires new air conditioning equipment to use reclaimed R-410A refrigerant in an amount equal to 10% of equipment operating charge in California.

Other States Follow California’s Lead

With California taking a leadership role in environmental regulations, other U.S. Climate Alliance states have adopted a similar approach. The U.S. Climate Alliance, with a shared commitment to reducing SLCPs and HFCs, includes 24 states and Puerto Rico. Sixteen states have either adopted SNAP 20/21 into state law/regulation or are in the process of doing so.

To reduce the complexity of implementation, industry advocates, including the Air-conditioning Heating and Refrigeration Institute (AHRI) and the National Resources Defense Council (NRDC), have asked for states to be consistent in their approach to adopting CARB’s rules. From an HVAC perspective, this prohibits chillers from using R410A, R134a, and other higher GWP fluids beginning January 1, 2024.

Refrigerant Safety Standards & Codes

Meeting the targeted emissions reductions in California will require the use of lower-GWP refrigerants. But many of these low-GWP, hyrdrofluoroolefin (HFO), HFC, and HFO/HFC blend refrigerants are classified as A2L, or mildly flammable. Product and application standards, UL 60335-2-40 4th edition and ASHRAE 15 have been updated for comfort cooling to define charge limits and mitigation required to limit the potential of a flammable event in case of a leak.

These standards will serve as the bases for codes that govern building, fire, and other local authorities having jurisdiction (AHJ), who will ultimately oversee the applications in which these refrigerants are used. It’s important to remember that building codes vary from state to state; thus, the adoption of flammable refrigerants will take place on local levels and may take years to accomplish. Below is a current snapshot of those states that have updated their building codes to allow for A2Ls in high-probability HVAC systems.

Federal Energy Efficiency Requirements

The U.S. Department of Energy (DOE) has the authority to establish minimum efficiency standards for air conditioning and heat pump equipment. The next set of energy efficiency increases will impact both residential and commercial rooftop equipment.

Regulations Continue to Drive HFC Refrigerant Phase-Down

The regulation of refrigerants continues to be a source of great uncertainty in the HVAC industry. As global, national and state regulations have targeted the phase-down of HFCs in recent years, the industry has seen a shift toward alternative refrigerants with lower global warming potential (GWP).

- COMERCIAL

- RESIDENTIAL

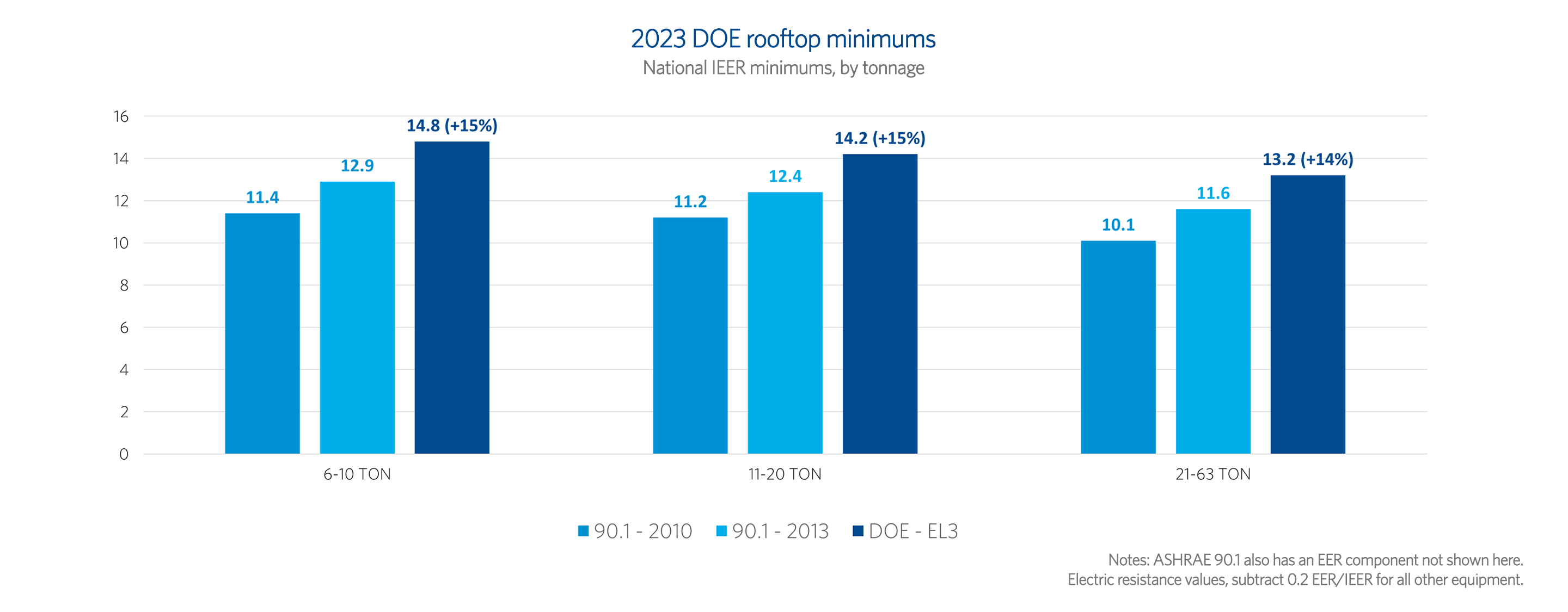

Commercial Air Conditioning

Commercial rooftop efficiency is represented as Integrated Energy Efficiency Ratio (IEER). The 2023 federal minimum efficiency was roughly a 15% increase relative to the 2018 efficiency levels.

Residential Air Conditioning / Heat Pump Energy Efficiency Standards

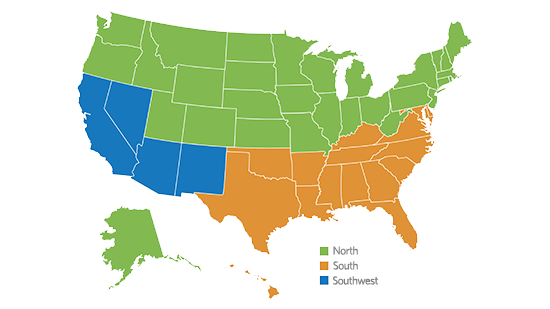

The table below show the minimum efficiency levels for residential air conditioning and heat pumps that took effect in 2023. Along with the increase in efficiency over previous levels, a new test procedure entered into force: 10 CFR Appendix M1 to Subpart B of Part 430 - Uniform Test Method for Measuring the Energy Consumption of Central Air Conditioners and Heat Pumps. Systems tested for this method use the nomenclature SEER2/HSPF2/EER2.

Because of the new test procedure, the increase in efficiency was not as transparent as in the past, but effectively there was a 1 SEER increase for both the north and south. To better correlate the old and new, the 2023 table below includes the new SEER2/HSPF2/EER2 and the equivalent SEER/HSPF/EER values in parenthesis.

| 2023 – Appendix M1 | All | North | South | Southwest | |

|---|---|---|---|---|---|

| Type | HSPF2 (HSPF) | SEER2 (SEER) | SEER2 (SEER) | SEER2 (SEER) | EER2 (EER) |

| AC < 45K BTU/Hr | - | 13.4 (14) | 14.3 (15) | 14.3 (15) | 11.7 (12.2) / 9.8* (10.2) |

| *NewAC > 45K BTU/Hr | - | 13.4 (14) | 13.8 (14.5) | 13.8 (14.5) | 11.2 (11.7) / 9.8* (10.2) |

| Heat Pump | 7.5 (8.8) | 14.3 (15) | 14.3 (15) | 14.3 (15) | - |

| Packaged Units | 6.7 (8.0) | 13.4 (14) | 13.4 (14) | 13.4 (14) | 10.6 (11) |

*9.8 EER2 limit for equipment ≥ 15.2 SEER2

![VN013_HVAC_Refrigerant_Efficiency_Standards_eBook_v5-1[2]-1 VN013_HVAC_Refrigerant_Efficiency_Standards_eBook_v5-1[2]-1](https://media.copeland.com/45ca3270-180d-40af-88d5-b15d000a079f/VN013_HVAC_Refrigerant_Efficiency_Standards_eBook_v5-1%5b2%5d-1_2%3a1_PNG.png?width=600)

![VN013_HVAC_Regulations_Efficiency_Standards_eBook_v5-1[1]-1 VN013_HVAC_Regulations_Efficiency_Standards_eBook_v5-1[1]-1](https://media.copeland.com/aaeede68-ee09-4582-a6bc-b15d000a0eed/VN013_HVAC_Regulations_Efficiency_Standards_eBook_v5-1%5b1%5d-1_2%3a1_PNG.png?width=600)